Vesting is a collective term for various methods, approaches, and patterns of token distribution following a token sale or other forms of cryptocurrency asset sales.

In traditional finance, the term "vesting" refers to gaining the right to control assets (such as stocks or pension savings) after a specific period of time or upon meeting certain conditions. For instance, employees might receive company stocks but won't be able to sell them immediately. This ensures their vested interest in the company's success and prevents market pressure from sellers that could drive down stock prices.

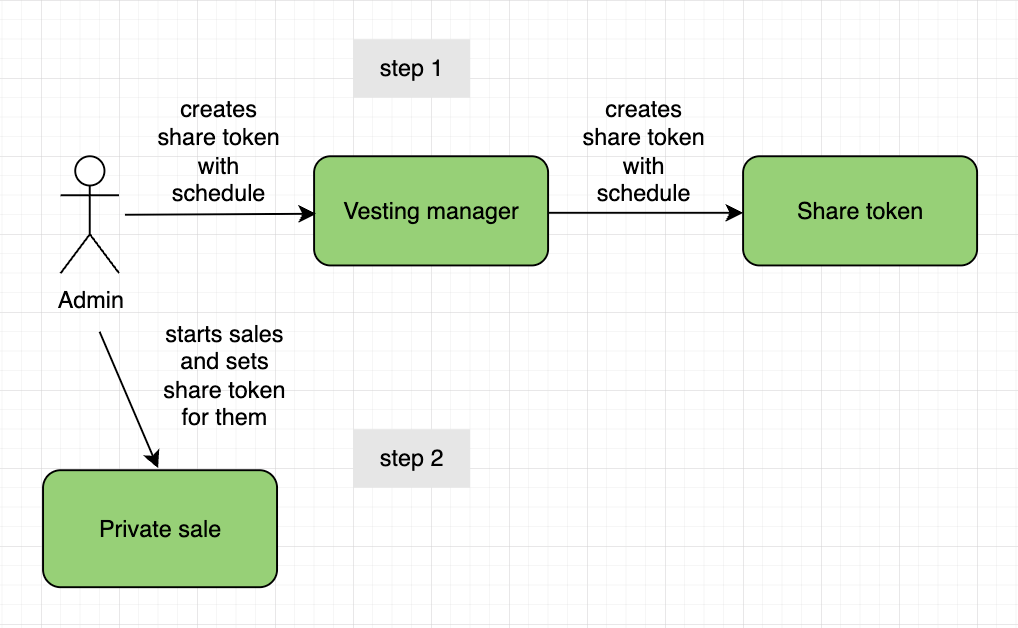

In the context of cryptocurrencies, vesting is an integral part of a project's tokenomics, which is designed considering human psychology and mathematical models. This helps maintain token prices under control, at least within certain ranges. Token sales often include multiple phases, such as seed rounds, private rounds, strategic sales, ICOs, etc. The token price can vary significantly between these phases.

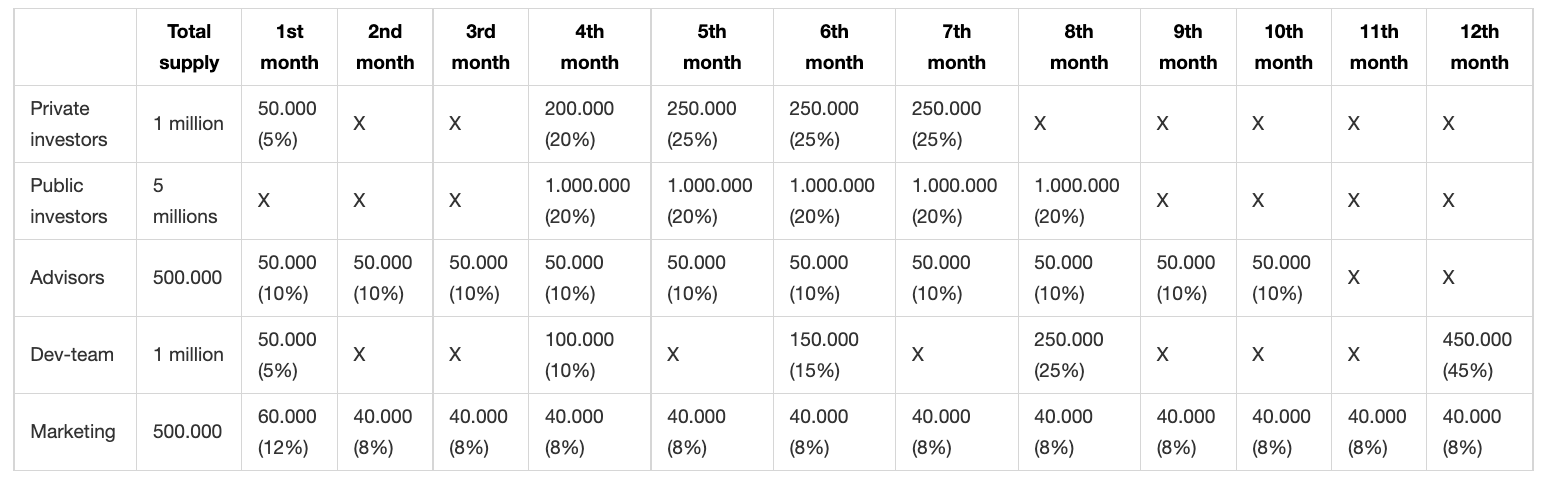

A well-designed and balanced token distribution schedule over time manages price fluctuations and overall project integrity. It especially safeguards against mass token sell-offs right after listing on exchanges, enabling price control in the long run. Vesting can also be utilized to incentivize project participants, like developers or marketers who receive tokens as rewards for their work.

It's important to note that not all tokens are subject to vesting since that would severely impact liquidity. Usually, vesting involves locking up around 10-20% of the total token supply, which can include tokens allocated to the team, investors, consultants, etc.